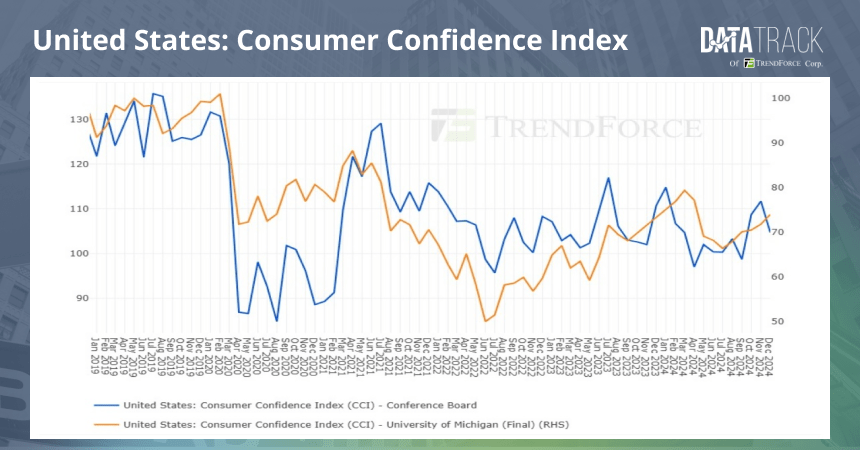

New York, NY – May 6, 2025 – The Conference Board Consumer Confidence Index® plummeted by 7.9 points in April, reaching 86.0 (1985=100), marking the fifth consecutive monthly decline. The latest data reflects heightened concerns over the economic outlook and consumer sentiment, with expectations reaching their lowest levels since the early days of the COVID-19 pandemic.

The drop in confidence was largely driven by a sharp downturn in consumer expectations. The Expectations Index, which gauges consumers’ short-term outlook for income, business, and labor market conditions, fell by 12.5 points to 54.4, a level not seen since October 2011, well below the critical 80-point threshold that often signals the possibility of a recession.

Key Findings from April 2025 Data:

Economic Impact and Outlook:

Stephanie Guichard, Senior Economist at The Conference Board, remarked on the troubling trend: “Consumer confidence has now fallen for five consecutive months, with the Expectations Index at its lowest point since 2011. This decline reflects deepening concerns about future economic conditions. Notably, the sharp rise in pessimism about job prospects and future income indicates that worries about the economy are now more personal for many Americans.”

Looking Ahead:

As inflation concerns remain high, coupled with consumer apprehension about tariffs, stock market volatility, and rising interest rates, the outlook for consumer confidence in the coming months appears uncertain. The continued decline in consumer confidence may signal further economic challenges ahead unless there is a significant shift in sentiment or economic conditions.

For more information about the Conference Board Consumer Confidence Index®, visit www.conferenceboard.org.

About The Conference Board

The Conference Board is a nonprofit research organization that provides trusted insights for businesses, governments, and other organizations around the world. Founded in 1916, it is known for its forward-looking economic data and thought leadership on global economic trends, labor markets, and social issues.

"Entrepreneurship is a story worth telling, and at SwiftNlift Group, we bring these stories to life. Our magazine showcases the journeys of ambitious entrepreneurs who have overcome challenges and achieved remarkable success. With every issue, we inspire, inform, and celebrate the limitless possibilities of innovation and determination."

651 N. Broad St.,

Suite 206, Middletown,

DE 19709, USA

Copyright Ⓒ 2023 – 2025 SwiftNLift. All rights reserved.